- Grow Mine, Ithuba Solutions lock horns

- Grow Mine plagiarised our bid -Ithuba Solutions

- lthuba submitted an inferior technical offering – Grow Mine

- Judgment on urgent application set for Thursday.

DITIRO MOTLHABANE

The fate of the issuance of a lucrative Lottery licence, an untapped industry estimated at over P100 billion annual turnover, will unravel before the High Court this February 2021 when a conglomerate of local investors styled Grow Mine Africa oppose an urgent application by Ithuba Solutions to interdict negotiations to award them the tender.

In the main court case, which is currently before Judge Omphemetse Motumise, Ithuba Solutions is suing the Gambling Authority contesting the selection of Grow Mine as the preferred bidder for the award of the lottery licence. Arguments in the urgent application were heard on Monday (1st February 2021), where Ithuba seeks to stop the Gambling Authority from continuing negotiations to finalise the issuance of the lottery licence to Grow Mine -the preferred bidder. Judgment is set for Thursday.

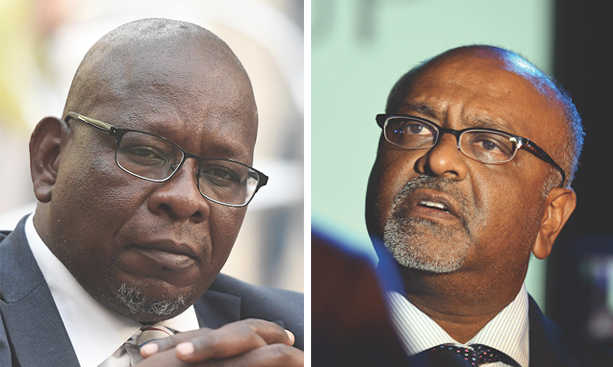

In an answering affidavit to Ithuba urgent application, Sefalana Holdings Group Managing Director, Chandrakant Chauhan, in his capacity as the Chairman of the Board Directors of Grow Mine Africa dismisses the Ithuba application saying it is not urgent and does not deserve to be treated with any degree of preference. Chauhan’s papers, which formed the core of Grow Mine arguments on Monday, followed the answering affidavit of Gambling Authority CEO, Thulisizwe Johnson, as well as confirmatory affidavits of Potlako Mawande and Vivien Natasen, relating to application processes for the National Lottery Licence in Botswana including the evaluation, adjudication and announcement of Grow Mine as the preferred applicant.

Having laid out the opposition to the application, Chauhan argues that the balance of convenience is not in favour of lthuba Solutions. On the contrary, the balance of convenience is against the grant of an interim interdict as its grant would be prejudicial to the interests of the public and those of Grow Mine, he said. “I deny that lthuba has demonstrated any apprehension of irreparable harm. I deny that lthuba does not have a satisfactory remedy..as they have a right to appeal to the Minister if its appeal is refused. I deny that this matter is urgent. The urgency is self-created. I pray that lthuba’s urgent application for an interim interdict be dismissed with costs,” he submitted, insisting that lthuba does not possess the requisite technical capability needed to successfully run, operate and administer the national lottery business as envisaged by the RFA, and the requirements of the Gambling Authority pursuant to section 61 to 72 of the Gambling Act.

Experience, expertise

Chauhan posits that it is cynical for Ithuba to participate in the entire bid process without ever raising any concern that PPADBA procedures were not being followed, only to do so at the stage when the Gambling Authority has selected Grow Mine in terms of the Request for Applications (RFA) and is about to commence negotiations for the Licence. Contrary to Ithuba claims,Chauhan argues, the PPADB Act applies only to the public procurement of assets, works, services, and supplies (or a combination thereof) as well as to the disposal of assets. He said Ithuba’s allegations concerning the application of the PPADB Act as a basis for undermining the decision of the Gambling Authority are therefore misconceived. THe insists that the PPADB Act and the Regulations promulgated under public procurement are only applicable to Central Government and local authorities, hence the reason state owned enterprises (parastatals) have their own procurement procedures, which differ from one entity to the other.

Accordingly, the issuance of a lottery licence by the Gambling Authority falls outside the scope and ambit of the PPADB Act and the Authority could therefore not follow the provisions and procedures set out therein, Chauhan submitted. He said in the past 18 years as the Group Managing Director of Sefalana, he has been involved extensively in public procurement processes undertaken in accordance with the provisions of the PPADB Act, as well other forms of public procurement for the supply of goods and services to government owned entities, such as parastatals and local authorities (town and district councils). According to Chauhan, through such regular participation in various public procurement tender processes and proceedings over the years, one becomes an expert in managing and/or overseeing all phases of the procurement cycle, being pre-tendering (invitations of expression of interest and pre-qualification), tendering, and post award phases, contracting negotiations, execution of contract agreements and contract implementation.

“My experience in such procurement cycles qualifies me as an expert in the procurement processes and procedures applicable in Botswana over many years and the scope, range and volume of business conducted. In the 18 years of my role as the Group Managing Director of Sefalana from 2003 to date, we have grown and expanded exponentially as a business. During this time I have been extensively involved in and/or managed procurement functions of the various business and I have never encountered nor am I aware of the issuance of a licence through the PPADB Act or its Regulations.,” he asserted.

Sefalana Holdings is a forty percent (40%) shareholder and therefore the majority shareholder, Grow Mine. It is listed on the Botswana Stock Exchange (BSE), with a market capitalisation of P 2.2 billion, having achieved an annual turnover from the year ended 30 April 2020 of over P 5.8 billion. According to its audited financial statements, published in the annual report and on the SSE’s X-news, Sefalana generated a profit before tax for its shareholders of P259 million. Sefalana is a well-diversified group of companies. Its manufacturing businesses rely significantly upon participating in and winning the Botswana Government tenders, which account for roughly P 400 million of Sefalana’s annual turnover, and most of them have been undertaken through the procurement process prescribed by the PPADBA.

Citizen Participation

According to Chauhan, during the evaluation process by the Gambling Authority for the grant of the National Lottery Licence, the minimum requirements for citizen participation were lacking in lthuba’s bid submission and during the Reference Site Visits. Grow Mine , on the other hand, was incorporated on 14 June 2016 as a special purpose vehicle to operate the National Lottery in the Republic of Botswana in accordance with applicable legislation and subject to the jurisdiction of the relevant regulatory authorities. The incorporation and purpose were specifically designed to comply with the requirements of the Request for Applications for the National Lottery Licenceissued by the Gambling Authority at the beginning of the National Lottery Licence application process.

Among the requirements was that the bid must have meaningful economic citizen empowerment, and meaningful participation and/or representation in key decision-making levels of the company by citizen shareholders; meaningful participation and/or representation in the key decision-making of the company, such as management and control by citizens of Botswana, and further a meaningful role and participation at the shareholder level of the company – that is, the substantial actual ownership stake, participation and economic empowerment of citizens in the corporate and shareholding structure of the company; a demonstrable plan involving training, development and transfer of skills to citizens; and that the technology partner of the bidder must have an office in Botswana. Further, bidders were required to submit a business plan which illustrates their ability to build an independent and profitable Botswana business which embraces all aspects of localisation through preferential local procurement and compliance with the Citizen Economic Empowerment Policy.

lthuba’s contention is that the Gambling Authority developed an obsession with citizenship participation but Grow Mine counters that it forms the core because where two bidders are equal in respect of technical ability and price the bidder providing greater empowerment of the citizens of Botswana must carry the day.

Grow Mine Africa is owned one hundred percent (100%} by a broad-based group of Botswana citizens. The element of citizen of Botswana indirect shareholding and participation within Grow Mine Africa is even larger or greater. For example, the largest shareholder in Sefalana, at forty-six percent (46%}, is the Botswana Public Officers Pension Fund (BPOPF), which means the largest indirect shareholding in Grow Mine Africa is the largest pension fund in Botswana which represents the interests of more than 150,000 Batswana. The composition of Sefalana’s largest shareholders alos includes the Motor Vehicle Accident Fund (MVAF)and the Debswana Pension Fund.

In comparison, it appears from the CIPA records that Ithuba’s shareholding is made up of Flameback (Pty) Limited- twenty five percent (25%) and Zamani Gaming (Pty) Limited- seventy five percent (75%). Further, the CIPA records reflect the shareholding of Flameback (Pty) Ltd as Boy Eric Mabuza- fifty percent (50%), Benson Masego Madisa- twenty five percent (25%) and Todd Mhenyadira Mangadi- twenty five percent (25%). “Therefore, Ithuba fell short of the key requirement to have meaningful citizen economic empowerment, genuine creation and distribution of wealth, and participation in the decision making and control by citizens of Botswana at the shareholder level of the company – the actual participation and empowerment of citizens in the corporate management and control, and the shareholding structure of the company,” argued Chauhan.

The Gambling Authority had also observed that “8.1.1 There was a concern around actual participation and empowerment of citizens in the corporate structure submitted. 11.3.1 Although undertakings made around local empowerment of Batswana citizens, which the Applicant had the benefit of in our assessment of your submission. However, at the Applicant presentations and the site visits the Authority did not see the local citizens being entrusted with any meaningful role, they instead, appeared to be dominated by the technical partner. The entire presentation and site visit was dominated by the foreign partner with little to no input from the local Batswana citizens, particularly the shareholders. The local shareholding element was of concern in that, on the face of it, it amounted to an effective 12.5% of the operator. Based on the undertakings that the 50% currently held by Mr Mabuza would be transferred to a local citizen shareholding vehicle, the Applicant was scored as if this was 25%. However, the lack of detail as to how this was to be implemented was in contrast with the level of detail elsewhere in your proposal. The ability of Zamani and Mr Mabuza to influence and direct the operations of Flameback were a concern to the Authority from a citizen empowerment perspective. The local Batswana partners did not come across as fully engaged partners creating the impression that the Applicant is strongly controlled by its South African majority shareholder”.

In a letter dated 26 July 2020, the Gambling Authority had observed that the only two (2) local Batswana partners did not come across as fully engaged partners creating the impression that Ithuba is strongly controlled by its South African majority shareholder. lthuba’s South African majority shareholder owns a commanding effective controlling interest of eighty seven point five percent (87.5%) shareholding in Ithuba Solutions, the Botswana registered subsidiary. “Thus, through a company called Flameback (Pty) Ltd, the two (2) Botswana citizens involved in lthuba namely, Messrs Todd Mangadi and Benson Madisa only owna combined shareholding interest of twelve point five percent (12.5%), that is an effective six point two five percent (6.25%) each of beneficial interest in lthuba is owned by citizens of Botswana, and it is respectfully submitted that therefore this could invite perceptions of ‘fronting’, ‘window-dressing’, ‘tokenism’ and the like, foreshadowed in the Code of Conduct for Contractors, and consequently, the Gambling Authority was well within its rights to highlight this as a major concern,” said Chauhan.

He argued that the subterfuge of using two (2) citizens of Botswana to window-dress, devoid of any real intention to transfer ownership is prohibited in procurement proceedings in Botswana. For example, the Code of Conduct for Contractors issued by the PPADBprovides that a contractor shall not be involved in fronting, tokenism, window dressing and ‘rent a Motswana’ practices in any form of public procurement. For the purposes of the Code of Conduct for Contractors, the terms “fronting”, “tokenism”, “window dressing” and “rent a Motswana” mean the misrepresentation of a material fact of the ownership, management and control of a contractor in order to appear compliant with citizen reservation and citizen preferential treatment and for material gain, advancement or advantage in the procurement process.

Technical Partner

As part of the Grow Mine Africa consortium, a technical partner by the name IGT Global Solutions Corporation (“IGT”) was appointed by Grow Mine Africa to be the technology supplier of Botswana’s first ever national lottery. IGT is the world leader in lottery technology and services, boasting a global market share of sixty percent (60%). It has also been instrumental in the creation of lotteries in jurisdictions as diverse as Trinidad and Tobago, as well as several lotteries in the United States of America, the United Kingdom, India, South Africa and Mauritius.

In South Africa, IGT has been the technology provider and the technical partner to Ithuba for several years, although for purposes of the Botswana national lottery IGT opted to provide a technical solution directly to Grow Mine Africa, instead of lthuba. Consequently, Grow Mine enjoys an exclusive partnership between it and IGT in Botswana, Chauhan said.

The Gambling Authority also identified inadequacies and shortcomings in lthuba’s technical submission in respect of the lottery technical systems and services. Specifically, the Gambling Authority stated in the letter dated 26 June 2020that: “There were concerns regarding the lack of Playtronix I Mu/tigame, and its compliance with best industry practice, but these were allayed to an extent at the site visit through the simulations. It was evident though that the Playtronix I Multigame platform was not yet fully operational. The weak point of the Player Protection proposal was the relative lack of detail regarding the Protection of Player’s Funds and Prize Liabilities.”

In turn, Chauhan argues that lthuba submitted an inferior technical offering. He said Grow Mine would be adversely and gravely prejudiced by an attempt by lthuba to delay the commencement of the negotiations for the Licence Agreement with the Gambling Authority, through this completely misguided and frivolous urgent application. He said lthuba is clearly clutching at straws for reasons only known to itself. Furthermore, it is most doubtful that lthuba, the South African company and for all practical arrangements, a foreign majority controlled corporate citizen, would have the best interests of Botswana and its people at heart, having demonstrably failed and without doubt, to embrace the empowerment of its citizens in its bidding packages submitted to the Gambling Authority for the National Lottery Licence.

Furthermore, the time for raising any objections by and/or on behalf of lthuba pertaining to the RFA has long passed. That time was between 3 March 2017 and 8 May 2017, being the stage the Gambling Authority circulated the draft RFA for the National Lottery Licence. The rationale of circulating a draft was to enable potential applicants, certainly like lthuba or Grow Mine, to provide their input on the said draft and its contents. lthuba did not at that time criticise the contents of the RFA; Between 28 May 2017 and 11 September 2017, being the phase during which the Gambling Authority invited queries and responses being shared with those purchaser-parties of the RFA; Between 11 and 12 July 2017, during the period the Gambling Authority had a compulsory bidders’ conference; On or before 12 October 2017, being the date for receiving applications, including the signing of the APA before then on 1 June 2017. lthuba clearly signed, and I confirm that Grow Mine signed the APA too, in terms of which we all bound ourselves, respectively to adhere and comply with the mandatory terms and conditions of the APA qua the individual capacity as an applicant for the National Lottery Licence; and at the lthuba bidder Technical Presentation to the Evaluation Committee held at Avani Hotel and Conference Centre in Gaborone on 21 January 2020.

According to Chauhan, lthuba is therefore estopped from raising any objections pertaining to the RFA and indeed to challenge any phase of the licence applications authorisation process. On the contrary, throughout the cycle National Lottery Licence applications authorisation process, lthuba by its words and deeds represented, and continued to represent that it was happy and satisfied with the process in question, and it took no step to challenge since 12 October 2017, the date of submission of the RFA until 3 July 2020, when lthuba lodged an appeal to the Minister.