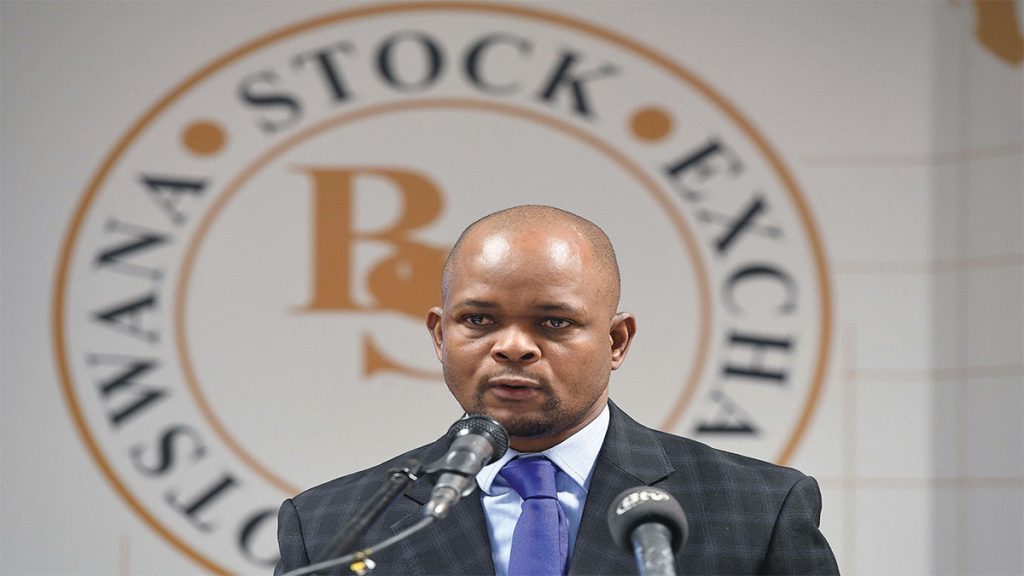

Tsheole lands in Kigali

From ZERO to P120m – Tsheole’s legacy at the BSE

In a space of eight years, he transformed the local bourse into one of the Top 5 on the continent; in the process earning a Presidential Meritorious Service Award. This is Thapelo Tsheole; the Mochudi native whose drive for excellence knows no bounds; a trait that has won him admirers from close and afar. He has now accepted a new challenge as the Chief Executive of Rwanda Capital Market Authority (CMA )

On May 29, Thapelo Tsheole entered the office halls of his new employers well armed to deliver on his lofty mandate – to steer Rwanda’s capital markets into a thriving operation that is attractive to investors. There is no doubt that Botswana’s loss has become a big gain for Rwanda. And the fast-talking sure -footed executive is far from being overawed by the new task at hand. After-all, he has done wonders to Botswana’s investment space – turning around the local bourse into a robust wealth generating machine.

Ask Tsheole about what made him so successful at the Botswana Stock Exchange (BSE) he minces no words in proclaiming the virtues of good education.

He was well armed with the requisite qualifications to master his craft and deliver a thriving exchange that raised his profile across the continent.

He is well grounded in business. With a single major economics degree from the University of Botswana, Tsheole turned himself into a financial markets guru by enrolling for a Masters in Financial Markets at South Africa’s Rhodes University.

But it is the MBA from the University of Cape Town, that he can’t stop raving about. “This institution is not named Africa’s No 1 Business School for nothing. Their programmes are solid and transformative. It shaped my work,” he declared.

He does not point to anyone in particular for having relied on to rise to the top. In terms of output in literally lifting BSE from obscurity to the centre stage of Botswana’s financial sector, Tsheole was like a bulldozer that pushed aside every obstacle.

“I have done the groundwork. My successor stands to harvest huge dividends from this,” he declares.

ACHIEVEMENTS – LEAVING BSE WITH P120M CASH

He assumed the leadership of the BSE in 2016 as CEO and there set off a transformational race that can only be matched by a few.

The workaholic in him knew very well that he would do well with a listening and ambitious team that prided itself with putting professional development at the very top of their priorities. No wonder it took them a few years to say ‘thank you’ to bail outs as they moved into profit-making and self sustenance.

He kicked off his reign with completing the demutualisation process – turning the exchange into a commercial entity. Swiftly the company was making millions. He prides himself in leaving the bourse with Cash Reserves of over P120 million.

He successfully established the BSEL Employee Share Option Scheme (ESOP); a key motivation in employee performance.

“I introduced the first Exchanged Traded Funds (ETFs) in Botswana, the first in Africa -ex RSA and achieved market turnover of over P1.1 billion and designing their trading, settlement, and regulatory framework. And more ETF Listings. I further increased investor participation in the BSE from around 23,000 in 2016 to more than100,000 in 2022 through Financial Literacy Programmes,” Tsheole declared with pride.

He has led BSE’s growth in international profile by overseeing its joining of Sustainable Stock Exchanges, World Federation of Exchanges, accreditation to Her Majesty Revenue and Customs.

“This was a rigorous process where we had to be assessed to ascertain that we were well qualified to be accepted,” he declared.

He succeeded in listing the first privatised Botswana entity in the BSE – Botswana Telecommunications

Corporation Limited (BTCL) and achieved record Fixed Income & Commercial Paper Listing while overseeing the admission of the BSE into African Exchanges Linkages Project in 2022. He has launched new technologically advanced systems for the BSE.

The BSE brand has become so strong that it has begun attracting investors from the region. “We have welcomed listing companies from Zambia, Zimbabwe, and even Mauritius. This is because our level of compliance is very high. Companies must operate within these confines. This is why we are able to attract more international companies because their investments remain safe,” he declared.

BSE has gone further to ensure that investors have their investment protected with the launch of an Investor Compensation Fund – which stands to “grant securities investors compensation for financial losses suffered as a result of a participant failing to meet their contractual obligations”.

Tsheole is of the view that things could have been even better in growing the capital market. “Things ought to have been done much faster in certain areas. One difficulty was getting the message across to policy makers to help us advance. Equally while it is important to advance citizen empowerment, restricting sales of certain stocks to citizens alone affects capital market development. There has been slowness in taking advantage of the full potential of the market,” he said, decrying the slow pace of private sector development, which has resulted with the domination of foreign investors in key areas.

AFRICA IMPACT

Tsheole’s impact at the BSE made him an attractive pick for more loftier positions in the region and beyond; the pinnacle of which was his elevation to the Presidency of the Africa Stock Exchanges Association (ASEA) from 2022 to 2024. He has been a board member and Deputy

President of the African Securities Exchanges Association from 2016.

He has been the Chairman of the Committee of SADC Stock Exchanges since 2018 – date and a board member of the Pan African Federation of Accountants from 2016 – 2021. His skill has been drawn upon locally as well to overseeing the running of other organisations having served as a board member of ACHAP Botswana, Botswana Accountancy Oversight Authority: 2016 – 2020 and Botswana Medicine Regulatory Authority: 2016 – 2018. He spearheaded the setting up of the Special Economic Zones Authority as Chairman of the Board from 2017 to 2021.

As Chairman of SADC Stock Exchanges, he successfully fundraised for “The SADC Green Bond Programme” and worked hard in supporting listings within SADC. “I spearheaded the bond market development in the region, calling for the centralisation of trading of bonds. I managed to secure sponsorship for harmonisation and interconnectivity of SADC markets, to allow cross trading,” he said. At Africa level, he said, they have managed to secure a second round of funding for the Africa Linkages Project.

THE TEAM

His philosophy in assembling his executive and overall staff was informed by the need to keep a lean and effective team that is well rewarded for its work. “I believe in training and developing staff to equip them well. I am happy that almost all staff had enrolled for an Executive development programme at the BSE,” he said. Having served for years under the leadership of Lt General Tebogo Masire as BSE chairperson, last year the Board welcomed a new chairperson in Neo Mooki – a leading investment guru who leads Generali Group in Milan, Italy. Generali is a global player in the insurance and asset management sector with an AUM of €700 billion. Tsheole cannot hide his excitement about the arrival of Mooki at the BSE, saying he was looking forward to an aggressive growth of the bourse with her. As fate would have it, this has unfortunately coincided with his decision to move for greener pastures.

“We have just returned from Doha, Qatar where we made a presentation on behalf of the BSE. We wowed the audience and created a massive impact about the value and potential of the BSE. She is set to do wonders,” he declared; reaffirming that he is happy that he is leaving the BSE in good hands.

Most importantly he is adamant that he has done all to set up the BSE for a strong and lucrative future. He pointed to the Tshipidi Programme through which they have been enrolling small companies to educate them on the value and benefits of listing on the BSE.

“We expect to see an increase in the listing of companies that have been enrolled in the Tshipidi Programme, which will further the value of the BSE,” he enthused; saying the recent move to increase local investment of pension money held by the Botswana Public Officers Pension Fund (BPOPF) will come in handy for the companies that are ready to list.

THE FUTURE

A breeder of dorper and ardent hunter, Tsheole is a busy body that equally cherishes a good time out with friends. His drive and insatiable appetite for exceeding the limits of his knowledge and achievements point to a man who will do all to make his presence and work felt in Rwanda. By his own admission he chose the Rwanda assignment because it was well aligned to his future outlook.

A man of his calibre though is constantly surrounded by opportunities, and it will not be surprising that the Rwanda detour will pave the way for a much bigger platform ahead. But first, just like he did at the BSE; he is bound to turn the Rwanda assignment into a testimony of his worth. He will outshine the mandate