- Economist predicts decline in households income

- Hard times as inflation surges to 11.9% in May

- Fighting inflation turns into a class war BoB

BAKANG TIRO

editors@thepatriot.co.bw

The central bank, Bank of Botswana, has painted a gloomy picture for the economy as its now anticipates inflation to revert to normal in third quarter of 2023 and not in the first quarter of that year as they had projected before.

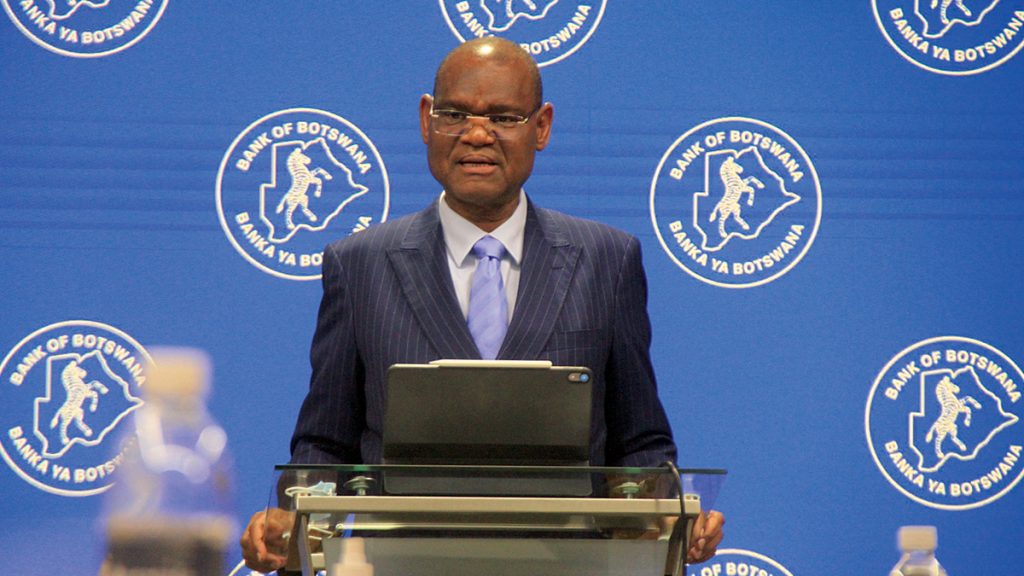

On Thursday, BoB Governor Moses Pelaelo warned of a worrying surge in inflation.

Pondering on the high rising cost of living amidst fears presented by rising infections of Covid-19, economist Dr Oscar Chiwira – Dean Faculty of Commerce at BAISAGO University – predict tough times.

According to Dr Chiwira, inflation surge may not be that much worrisome but income is worrying.

“What is worrisome is the basket of the general goods consumed by majority of middle and low income households whose price has increased far beyond the overall consumer index,” he said.

In addition, he said, private sector employees will feel more pinch of surging cost of living.

He said civil servants are cushioned better by the five percent salary hike they got recently.

“With the low and middle income households, those belonging to the private sector and the fixed income earners like the pensioners will be mainly affected. This emanates from lack of significant cost of living adjustments to cushion from the evils of galloping or runaway prices,” he said.

Dr Chiwira said the Pula value of stagnant income of low earners is eroding on daily basis.

BoB quandary

The central bank has once more adjusted the Monetary Policy Rate (MoPR) by 50 basis points from 1.65% to 2.15% with an anticipation of arresting inflation.

Pelaelo said inflation rose from 9.6% in April to 11.9% in May, 2022, remaining above BoB medium- term objective range of 3-6%, with the increase driven by latest adjustments on fuel prices.

“The current high level of inflation is mainly driven by supply-side factors, which contribute approximately 6.1 percentage points to the prevailing inflation (May 2022). The MPC projects that inflation will, in the short term, remain above the objective range but trend downward from the fourth quarter of 2022 and fall within the medium-term objective range of 3 – 6 percent from the third quarter of 2023. This represents a revision of the trajectory for inflation from the April forecast, influenced by subsequent increase in fuel prices and transport fares,” he said.

According to the seemingly bothered Governor, the projected decrease in inflation in the medium-term is due to dissipating impact of earlier increase in domestic administered prices.

“These risks are, however, moderated by the possibility of weaker than anticipated domestic and global economic activity due to geo-political tensions and possible periodic lockdowns and other forms of restrictions in response to the emergence of new COVID-19 variants and rising infections, with a likely further dampening the effect on economic activity,” Pelaelo highlighted.

Director of Research and Stability Department at BoB Dr Lesedi Senatla, said inflation will pick in the coming months due to increased volatility in the economy.

“We are seeing food prices going up significantly. Increase in domestic fuel prices is the main driver of inflation. However, we remain adamant that inflation will normalise,” said Dr Senatla.

According to the April 2022 World Economic Outlook (WEO), global output growth expanded by 6.1 percent in 2021, and is expected to moderate to 3.6 percent in both 2022 and 2023 respectively.

“The growth estimates for Botswana for 2022 and 2023 are 4.3 percent and 4.2 percent, respectively. South African GDP grew by 4.9 percent in 2021, and the South African Reserve Bank estimates growth of 1.7 percent and 1.9 percent in 2022 and 2023, respectively,” said Governor Pelaelo.

Despite the pressure piled by inflation, BoB says the MPC notes the growth-enhancing economic transformation reforms and supportive macroeconomic policies currently being implemented.

“These include accommodative monetary conditions, improvements in water and electricity supply, reforms to further improve the business environment and government interventions against COVID-19, including an effective vaccination rollout programme,” Pelaelo highlighted.