Concerned about glaring weaknesses in the Botswana Public Officers Pension Fund (BPOPF) Board of Trustees and other financial institutions, the Non-bank Financial Institutions Regulatory Authority (NBFIRA) has tightened crews demanding that members must hold a qualification in Finance and Actuarial science.

Actuarial science is the discipline that applies mathematical and statistical methods to assess risk in insurance, finance, and other industries and professions.

The Patriot on Sunday is reliably informed that last month NBFIRA wrote to non-bank financial institutions informing them that starting next year the regulations have been amended by adding a new requirement for the cited qualifications for board members. The new requirement is a result of numerous blunders caused by poor oversight owing to failure by the Board of Directors to execute fiduciary functions diligently over management of assets, particularly at the filthy rich BPOPF which controls a large chunk of the investment market. Such ineptitude is aptly reflected in the BPOPF/ Capital Management Botswana (CMB) scandal where the Fund lost around P440 million after repeatedly approving unlawful drawdowns. From the onset, the Botswana Opportunities Partnership (BOP) was shrouded in controversy when then Board Chairman, Carter Morupisi, assisted by the then Acting Principal Officer, usurped the powers of the board and unilaterally signed the CMB contract.

Weaknesses in the BPOPF Board were also identified by SquareLink – a Human Resource Consultancy firm engaged to assess the competency of Trustees, who scored very low marks. The Board members were found to be largely clueless about providing oversight for the Fund. Most of the Board members were found to be passive passengers who are unable to make effective decisions for BPOPF to prosper.

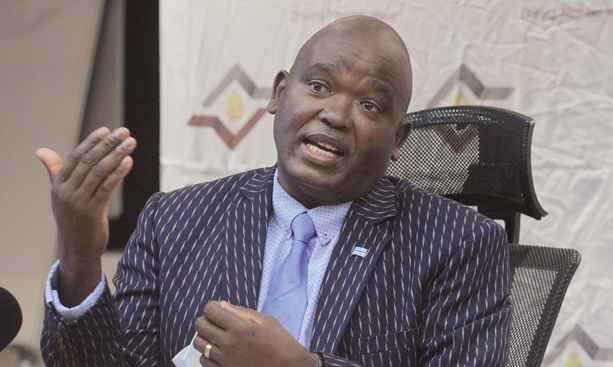

Already, indications are that NBFIRA will face stern resistance from employee constituents who are represented by trade union leaders (the labour sector). Secretary General of Botswana Federation of Public, Private and Parastatal Sectors Union (BOFEPUSU) and Botswana Sectors of Educators Union (BOSETU), Tobokani Rari confirmed to The Patriot on Sunday that they are aware of the letter from the Regulator. “We take a dim view of the requirement as it is clearly calculated to dictate to constituent members of the BPOPF, where we have trade union representation, who to send as their representatives to the board of trustees. This is clearly interference. We are studying the implications of the proposed amendment with a view to challenge it one way or the other,” said Rari, about their preliminary impression on the move by NBFIRA.

Deployed by the teacher trade union, Rari is the current Chairman of the Investment subcommittee of the BPOPF Board and Chairman of Mascom Wireless Board of Directors where the fund holds 40% shareholding through a company called DECI.

Govt meddling

In yet another development, NBFIRA has grown cold feet after the Directorate of Public Service Management (DPSM) told the Regulator that they were reinstating employer trustees who were expelled for violation of the Fund Rules. The announcement was made a day after BPOPF Board ended their relationship with the Principal Officer, Boitumelo Molefe. A source said, to date NBFIRA has not communicated their position on the matter to BPOPF, which currently runs with only seven trustees from a possible eleven. Trade unions have four trustees, while government only has two, alongside an independent trustee Ruta Moses.

Government has long shown desire to take control of BPOPF but were blocked by Molefe, who consistently resisted pressure from government officials to submit to their demands.

Molefe’s major undoing was firmly telling government officials to steer clear and refrain from meddling in internal matters of the fund, among them the operations of the BPOPF. The employer (government) and the trade unions are just constituent members, and therefore do not have a say in the management of the affairs of the Fund or its Board of Trustees, she insisted adamantly without yielding. Such conviction and independence infuriated senior government officials at the Ministry of Finance and the Office of the President (OP) and ultimately sealed her fate at BPOPF.

In the build up to her termination, The Patriot on Sunday can confirm that Masisi summoned Molefe, BPOPF Board Chairman Solomon Mantswe to a meeting that was also attended by Minister for Presidential Affairs Kabo Morwaeng and Permanent Secretary in the Ministry of Finance Wilfred Mandlebe. The latter two were just spectators at the meeting, beyond Morwaeng mumbling something about him representing the interests of civil servants. The OP meeting followed a failed attempt earlier by Mandlebe to summon Molefe and Mantswe to his officer to read them the riot act. While Molefe boldly declared that she does not report to the PS or any government official, Mantswe tried to get other Board members to accompany him to the meeting but they too stood their ground.

Although on paper the agenda for the OP meeting was for BPOPF -the custodian of public servants pensions and a critical stakeholder as the single biggest institutional investor in the economy, to update the presidency about their operations following a spate of scandals that led to multi-million pula losses, it turned out to be an attempt to reign in Molefe and intimidate the BPOPF leadership into subordinating themselves to state machinery.

For example, notwithstanding reasons advanced for indiscretions committed by the concerned officers Masisi openly expressed disappointment over the expulsion of some Board members mainly the Accountant General Emma Peloetletse, who is the supervisor of all government mega accounts. Peloetletse, then Chairperson of the Investment Committee of the BPOPF Board, was expelled after it was established that she and her spouse benefitted sponsorship from Capital Management Botswana (CMB) Directors, Rapula Okaile and Timothy Marsland, for an all-expenses paid holiday in Cape Town, South Africa which she never declared to BPOPF secretariat. Subsequently Peloetletse was reported to the Regulator (NBFIRA) and the Directorate on Corruption and Economic Crime (DCEC) because her relationship with CMB Directors who were being investigated for defrauding BPOPF millions of pula raised suspicions of collusion.

Despite being investigated by DCEC Peloetletse remained untouched. Public Service Act (PSA) Section 35 dictates that; (1) if the supervising officer becomes aware that criminal proceedings have been or about to be instituted against an employee, or considers that disciplinary proceedings should be instituted against a public officer, and is of the opinion that such officer should be suspended from the performance of his or her duties pending the taking of proceedings against him or her, the supervising officer shall report the matter in writing to the Permanent Secretary recommending the suspension of such employee”.

“We were concerned that there could have been more to the relationship than the all expenses paid Cape Town holiday. As the Chairperson of the Investment Committee, Peloetletse rendered advice to the board on decisions to make about investing BPOPF millions. Some of those decisions directly affected CMB and its Directors who sponsored the Cape Town holiday,” one Trustee said.

Peloetletse never appealed her termination but instead her defence came from the highest office in the land- OP. Instead, Masisi proposed at the meeting with BPOPF leadership that a more amicable solution could have been adopted to resolve the matter, a sugar-coated insinuation that it was wrong for BPOPF Board to fire Peloetletse.

Not a saint

One of the expelled Board members, who was removed because he had omitted to declare that his wife is an employee of BPOPF, Brigadier (retired) Charles Nkele, does not believe Molefe is the Messiah she was made out to be. Consequent of an expose by The Patriot on Sunday about an attempt by DPSM to have him and others reinstated to the Board, Nkele invited the Editor to a tete-a-tete on the goings-on at BPOPF. In a no-holds-barred intercourse Nkele stopped short of labelling Molefe a schemer, corrupt, incapable and consumed by petty jealousy. Premising the discussion on his background and experience on financial matters gained over an illustrious career spanning decades at Botswana Defence Force (BDF), he was quick to explain that he is qualified in passing judgment on financial management. In his view Molefe’s approach was in some instances unorthodox.

Further, Nkele accused Molefe of developing a habit of not attending at the office on Monday mornings, which created challenges for operations due to her strategic position. Molefe’s enemies also accuse her of passing jobs to friends. One example they gave was the appointment of an asset consultant who earned a mouthwatering monthly retainer despite that Novare, an asset consultant firm owned by Olebeng Ngwakwena was already appointed by BPOPF Board to perform the same function. Just before she left BPOPF, they said, Molefe is alleged to have signed a luctative contract for a public relations and marketing consultancy to with HotwirePR, a company owned by Kabelo Binns.

A witchhunt

Without hesitation, Nkele blames his removal from the board on Molefe. He is of the view

that Molefe hated him and Peloetletse because they were the only board members who hold qualifications in Finance and could therefore identify weaknesses her management style. One example of poor management, cited by Nkele and other board members,

was failure by BPOPF secretariat to produce financial statements for members for a period spanning over three years, a development which caught the attention of the Regulator (NBFIRA) who threatened to penalise the Fund. “It was failure on her part. There were many complaints within and outside the Fund as members demanded answers on their accounts,” said one Trustee.

Therefore, Molefe did not take kindly to being challenged to account at BPOPF board meetings and in retaliation masterminded a plan to have Nkele and Peloetletse removed, Nkele alleged.

In his defense, the retired army officer claimed to have notified the Board about his wife’s employment in the BPOPF secretariat but remains adamant that such does not create any conflict of interest. He even answered in the affirmitive when quizzed if it is possible for a husband to keep everything that transpires in Board meetings from his wife. Nkele’s wife was a surbordinate to Molefe who in turn reported to the Board of Trustees where the husband sat as a trustee representing BDF.

Nkele dismisses Peloetletse’s allegations of non-disclosure of her sponsorship by CMB Directors as trivia and petty witchunt because many other Board members had enjoyed similar benefits from companies doing business with BPOPF. He cited specific examples of a number of asset management companies, who are given BPOPF contracts/ mandates worth billions of pula, saying they have in the past been authorised by management (which included Molefe) to sponsor some trustees. “So, that practice has always been there. Why single out Emma?” he quipped rhetorically, but avoiding to answer specifically if such practice does not breach BPOPF Rules.

Probed further, Nkele flatly denied that he had become so well informed about the daily goings-on at BPOPF because his wife is an employee in the organisation.

‘It’s all lies’

When contacted, shortly after she left BPOPF Molefe rubbished all accusations against her, saying every transaction done at BPOPF under her reign was done transparently. She attributed allegations against her to ignorance of management and how financial institutions operate. Ironically, she said, it is strange that her accusers were part of the Board that made the decisions and approved the contracts only for her to implement. “It is totally immature and unprofessional for my employer (a Board member) to discuss my performance and conduct with third parties, including the media. I did not participate in the removal of any trustee from the board as that is not my mandate. I sat on the BPOPF Board as an ex officio member to answer for operational issues and daily running of the business,” she said, ever reluctant to delve into the details of our enquiry.