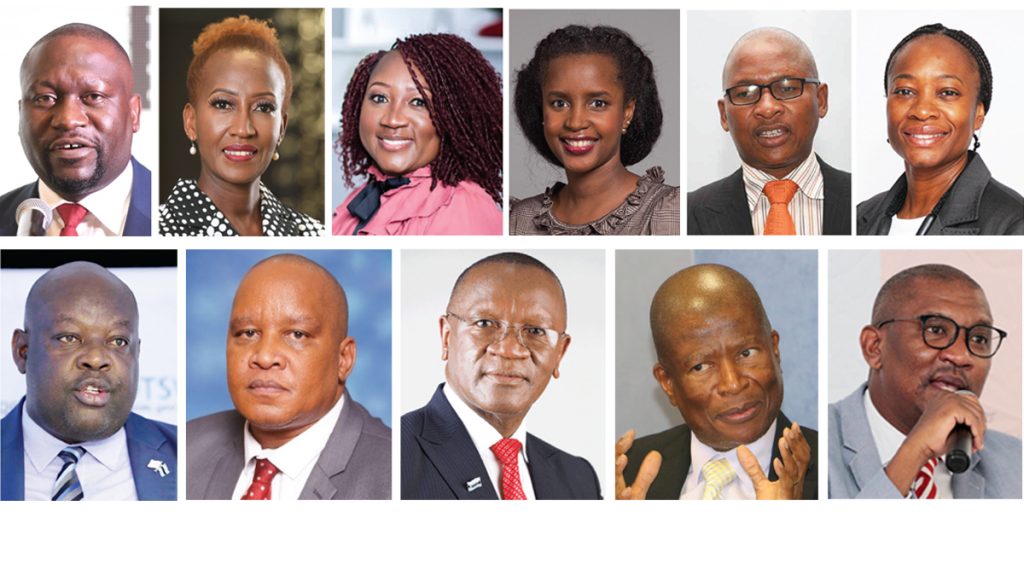

A year is often too short to demonstrate your worth, yet that’s exactly what the newly appointed Chief Executive Officers (CEOs) have to do to show that they deserve their enviable roles. PATRIOT BUSINESS looks at CEOs who shall be all too eager to impress in 2023.

Letshego Holdings CEO – Aupa Monyatsi

Having assumed the top position in June last year, Monyatsi has had time to pick his priorities well and adjust to the demands of his new role. With the last results having been slightly subdued, it is expected that he will work his magic to return the company to solid performance. With the boardroom storms that resulted with the sacking of the previous CEO and the reconfiguration of the board now a thing of the past, focus has shifted to business performance. Letshego comes into this New Year having the dominant player at the Botswana Stock Exchange (BSE) – having been the most traded stock every month of the past year. It is this solid performance that has rendered the company into a target of top regional companies that want to acquire it. Monyatsi is expected to keep his eyes on the ball – pushing sales while balancing the expectations on the business by shareholders and external forces that threaten to exploit its success.

Metropolitan Life MD, Boitumelo Mogopa

The veteran banker took over as Managing Director of Metropolitan Life Botswana in October – the highest corporate position she has ever had though having served as a board member of a number of organisations. She has predominantly worked in banking, going up the ladder to the position of Retail Director at First National Bank Botswana (FNBB) – the company she left to take charge at Metropolitan Life. Bogopa has already hosted a stakeholder’s session to introduce herself but as she well knows it will take much more than that – customers want and expect real value. In a highly competitive insurance sector, she will have to bring out her A game to show her mettle while generating shareholder value.

Liberty Life Botswana Managing Director, Joy Buno

After acting on the role for some months, Joy Buno was ultimately confirmed as the Managing Director of Liberty Life Botswana mid last year. Having been with the company for some years, Buno could find it easy to navigate due to the familiarity of the terrain. But she has entered a new office whose demands are high. She has to steer Liberty Life in a highly competitive insurance market and under challenging economic environment where people often feel keeping policies are a luxury on the face on immediate and more serious needs. In her short span at the helm she has already overseen the opening of the Francistown branch and the improvement of the processing of funeral claims to just four hours from 48 hours.

Orange Botswana CEO, Néné Maïga

Having had problems with her key subsidiary – Orange Money – when its distributors pulled out due to low commission it remains to be seen how the CEO and subsidiary leadership would shape up this year to restore the credibility of the money business. This is besides facing stiff competition from the two other cellular and data services provision networks that are sparing no effort at outcompeting each other. Maiga has been named among Africa’s Most Influential Women in leadership by an independent body – House of Rose Professional Pte. Ltd (HORP).

Botswana Investment and Trade Centre (BITC) CEO, Keletsositse Olebile

Last year they spent big to host a long running Botswana exhibition in Dubai that culminated with Botswana Day celebrations that country. While the full return on such a huge investment is still to be confirmed the quick answers to critics included pointing out that Botswana’s diamonds sales arm – Okavango Diamond Corporation (ODC) – made huge earnings by selling lucrative diamonds during the Dubai exhibition. BITC also insist that that was the best stage to sell the country’s brand. Focus remains on Olebile and his team once more this year as they prepare to host another huge event – the 15th US-Africa Business Summit. While some continue to question the huge investment on BITC, the executives have equally been adamant in pointing to the growing foreign direct investment the country is securing.

BBS Bank Managing Director, Pedzani Tafa

On the hot seat from January 04, 2023 Pedzani Tafa has her job cut out. She has to drive BBS transformation to a fully-fledged commercial bank starting 2023. Bank of Botswana granted BBS the license in December after years of a demutualization exercise that was undertaken to transform BBS from a Society into a business entity. Tafa, with vast experience in banking having been a retail director at Standard Chartered Bank Botswana before taking the higher role of Chief Operations Office at Botswana Savings Bank (BSB) now faces the arduous task of actualising Botswana’s first indigenous bank.

BSB Managing Director, Nixon Marumoloa

In 2022 BSB embarked on a massive expansion drive, opening numerous branches around the country and introducing additional services as the portfolio of the bank grew. As per a filling at the Botswana Stock Exchange (BSE), the bank drew down over P100 million from on its P1 billion note programme in December – listed exclusively to increase its loan book. The bank’s loan book under Marumoloa has increased from P1.8 billion to almost P3 billion. Having launched a new strategy last year – Lesedi2025 – the bank intends to go fully-digital, be aggressive in ensuring financial inclusion to emerge as a leading Botswana-owned integrated financial service provider. However, having pushed most of their products over the years through BotswanaPost network it remains to be seen how they will navigate their way forward following developments that show that their relationship is under strain.

PNRB CEO, Montwedi Mphathi

As demand for copper rises due to the opening up of China, prices are expected to soar. All eyes will be on Montwedi Mphathi to see when he will deliver the re-opening of Selibe-Phikwe and Tati Nickel mines to exploit opportunities in the copper/ nickel market. Mphathi, the former General Manager of BCL mine, whose assets they have now bought through a partnership with Canadian investors – Premium Nickel Resources is expected to advance further in re-opening the mine. He is known for his shrewdness and strict management having been the first citizen to head BCL and Botswana Ash mines. He is returning to Phikwe at a critical time when the area is crying out for new investment and employment generating activities. He carries hopes for hundreds of former employees who were retrenched when the mine was closed.

BIUST Vice Chancellor, Prof Otlogetswe Totolo

Through Botswana International University of Science and Technology (BIUST), the country is expected to launch its first Satellite this year. The satellite, called BotswanaSat-1 (Bot-SAT-1), is a cube satellite or a nanosatellite and is being spearheaded by BIUST scientists. “The satellite, which will be used for earth observation, will generate data for smart farming and real-time virtual tourism. Furthermore, it will help us predict and forecast harvest time through the use of robotics and automated technology. It will also make it easy for our people to access key facilities, particularly financial support and accurate market outlook and projections using data generated from space,” said President Mokgweetsi Masisi when launching the project. This means that all eyes are on Professor Otlogetswe Totolo and his team of scientists to deliver on this major project. The institution is touted as the best suited to driving a knowledge based economy. Prof Totolo has a mammoth task ahead to not only churn out requisite human capital into the economy, but to also partner industries and other institutions of learning to achieve this.

BUAN Vice Chancellor, Prof Ketlhatlogile Mosepele

Having been appointed the second Vice Chancellor of Botswana University of Agriculture and Natural Resources, Professor Ketlhatlogile Mosepele faces a big task of generating sufficient skilled personnel who can help transform the agricultural sector and boost its performance. The country’s ambitious drive of reducing the import bill saw it closing borders of horticultural exports and demanding that locals fill the arising gap. It has not been easy, with complaints that local producers are falling far below expectations in meeting market demands in terms of quality of produce and its quantity. Mosepele should steer BUAN into making its contribution in reducing the import bill by producing for the market as a way of also reducing overdependence on government subventions. The quality of instruction from his academics should be high enough to prepare graduates enough to become fulltime commercial farmers themselves.

TICANO Group CEO, Opelo Motswagae

A champion for Purchase Order Financing and Invoice Discounting in Botswana, Ticano funded 1800 SMEs in 2022 across Botswana, with more than P300 million. The company is in the process of launching an online Supply Chain Finance application platform to reach remote areas and give SMEs access to speedy finance. The company will soon launch First Medical – a programme giving access to medical services to low income underserved market. Ticano will soon open two new branches in Jwaneng and Ghanzi in 2023. “We are partnering with corporates for Supplier Development Programme to provide access to speedy finance and service delivery. We have also been accepted into the Stanford Seed Programme,” said Motswagae, who just returned from Kenya where he participated in the Stanford Seed programme.

In November 2022, Motswagae was appointed Board Member and Chairman of the Audit Committee for Botswana Ash and Botash SA.